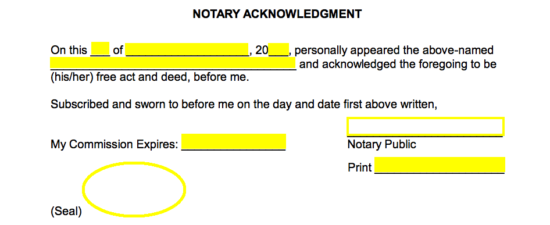

This may include physical property as well as records, policies, funds, and bank accounts. Once the affidavit has been notarized, the successor will be able to use it to collect estate property and funds from their current custodians. Death certificates can be requested from Vital Records by mail, telephone, online, or in person. The notary may require a certified copy of the decedent’s death certificate. The affidavit must be presented to a notary public to be notarized. Once the mandatory waiting period has passed, the successor can complete the Affidavit for Distribution of Property. If an estate meets those requirements, the successor will need to wait forty (40) days from the date of death before they can execute and use an affidavit. Furthermore, any debts and taxes due on the decedent’s account must be paid in advance or provided for in the affidavit. To be eligible for a small estate affidavit, the decedent’s estate must be valued at $50,000 or less and contain no real property, unless said real estate is exempt from inheritance tax through rights of survivorship. Step 1 – Requirements and Mandatory Waiting Period Step 2 – Complete and Notarize Affidavit.Step 1 – Requirements and Mandatory Waiting Period.

0 kommentar(er)

0 kommentar(er)